Whereas shifting the tax burden off of investment (most directly, off of business) on to consumption, especially consumption that creates a negative externality (e.g. environmental damage), is the perhaps the most popular policy prescription of economists at the macro level, at the municipal level the call is for land value taxation.

According to Canadian economist and Nobel Prize winner William Vickrey:

removing almost all business taxes, including property taxes on improvements, excepting only taxes reflecting the marginal social cost of public services rendered to specific activities, and replacing them with taxes on site values, would substantially improve the economic efficiency of the jurisdiction.

In other words, aside from tax revenue that can be roughly categorized as user fees, taxes on real estate improvements ("one of the worst taxes", in Vickrey's words) should be minimized in favour of taxes on site value "("one of the best taxes").

Vickrey is not alone here. Others have claimed that

Economic theory and, to a lesser degree, empirical evidence support the claim that taxing land values instead of wages, profits, or capital values would improve economic performance and could improve people’s lives. (p. 10)

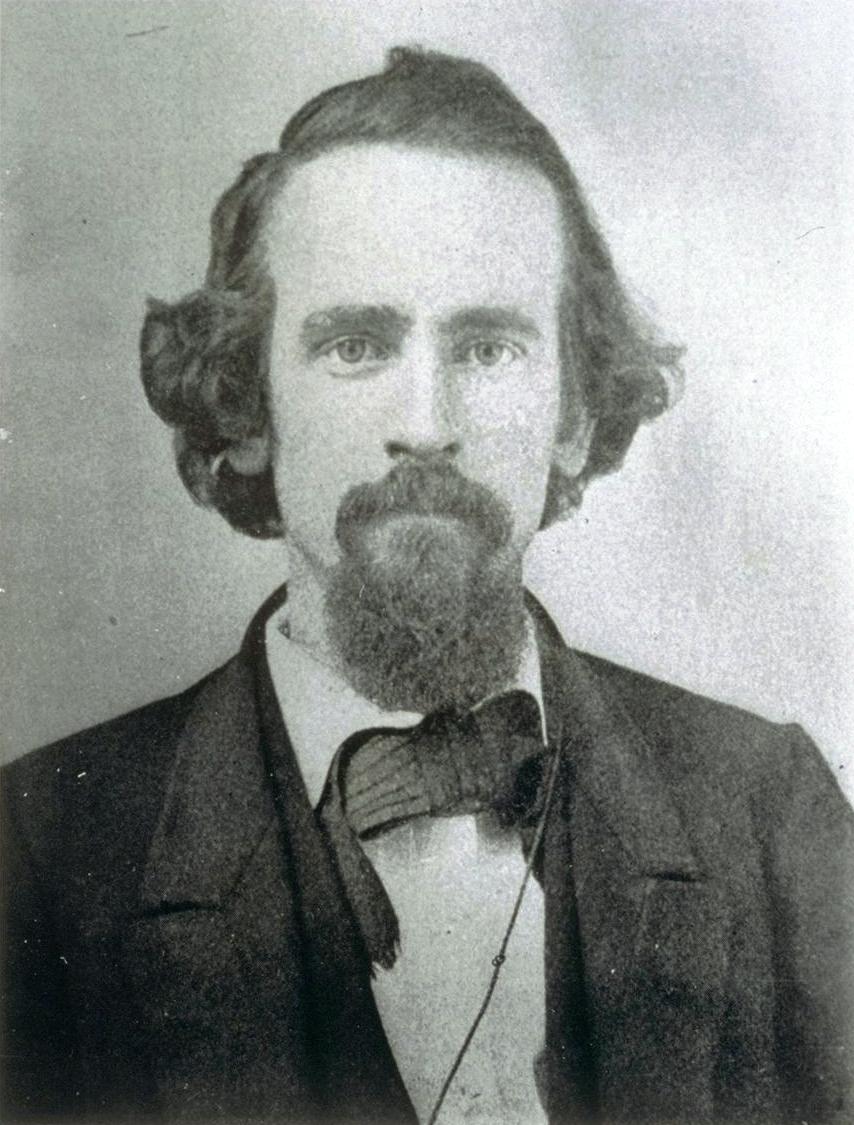

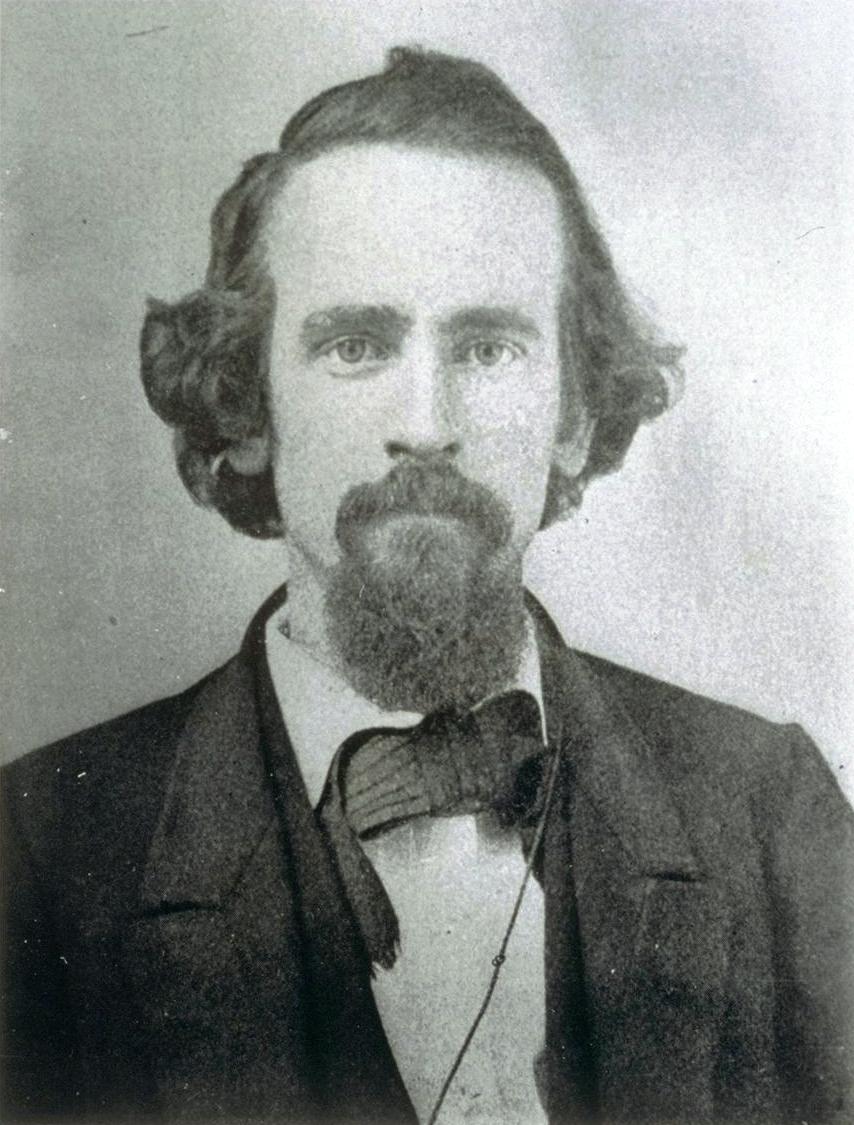

Indeed, 7 other Noble Laureates besides Vickrey have endorsed the idea, although one should be careful about transferring the authority that a Nobel Prize implies in a particular field of economics to another field, case in point being Vickrey's dubious defence of large budget deficits. Vickrey may be a hard-core Keynesian, but on the merits of land value taxation,  Milton Friedman agrees with Vickrey: "the least bad tax is the property tax on the unimproved value of land, the Henry George [right] argument of many, many years ago."

Milton Friedman agrees with Vickrey: "the least bad tax is the property tax on the unimproved value of land, the Henry George [right] argument of many, many years ago."

Milton Friedman agrees with Vickrey: "the least bad tax is the property tax on the unimproved value of land, the Henry George [right] argument of many, many years ago."

Milton Friedman agrees with Vickrey: "the least bad tax is the property tax on the unimproved value of land, the Henry George [right] argument of many, many years ago."Note also that the benefits of a location well served by civic services and public infrastructure will be capitalized into higher land value such that the revenue returned to the government by site value taxation is proportionate to the added economic value generated by its services.

If a land value tax system were implemented, the tax payable of property owners would change according to the proportion of the property's value attributable to land. According to a study of a decade ago titled "Implementing a Land Value Tax in Urban Residential Communities," property sales in the Edmonton neighbourhood of Clareview suggested that, on average, land represented 35% of sale value.

A half-way house towards a shift to a land value tax is split rate taxation, whereby the tax rate on the value of the land is set significantly higher than that on improvements. According to a 2003 study, more than 700 cities around the world use a split-rate property tax system. In North America, however, the land value tax idea has seen little implementation.

Now how does this relate to the election in E-Town on October 18? Money issues are not everything, of course (consider the fact that statistics showed a drop in west-end crime because of the work of volunteers from the Beulah Alliance Church), but taxation does matter and moving to land value taxation would stimulate urban core development while preserving the environment and reducing urban sprawl. The candidates who have talked most loudly about the value of these objectives, however, have typically done the most to undermine them by supporting higher property tax rates, especially on businesses (which include non-owner occupied condos and hotels, which would have amongst the highest building to land value ratios) relative to single family residences (which would have amongst the lowest).

At 1:34 of the video below, you see councilor Don Iveson contending that more spending on transit would encourage more people to move into the city centre, his logic being that more municipal government spending would increase incomes. Why this increased income wouldn't be spent on housing in the 'burbs, or where this additional money for transit is supposed to come from, isn't explained.

What's particularly galling is that in the process of getting on city council, Iveson took out Mike Nickel, the one candidate in recent years to take issue with the prevailing policy that sees businesses pay higher tax rates than individuals.

I'd give Iveson due credit for running a campaign 3 years ago that up-ended an incumbent, but I think that the significance of that campaign has been rather oversold. To begin with, Iveson "lost" to incument Bryan Anderson. It just so happened that at the time a 2nd place finish still got one a seat at the council table. As Alex Abboud has noted, had the new ward system been in place in 2007, Iveson would have lost to Anderson in the new Ward 10 that Iveson is currently running in, and in the more southerly new Ward 9, which constitutes the rest of the bulk of the old ward, Iveson would have finished third (30% Anderson, 28% Nickel, 25% Iveson). The straightforward explanation for why Iveson beat Nickel is that Iveson was ideologically left, Nickel right, and everything north of the Whitemud, and especially north of 61 Ave, between Whitemud Creek Ravine and the river (on the west) and Gateway Blvd (on the east) tilts left, getting even more left as one progresses north to the U of A campus and the river, such that in the far north of the old ward that is now Ward 8, Iveson swamped Nickel 38% to less than 15% (with Anderson taking 27%).

The lesson from this is that in 2010, the only incumbent in any serious danger is Tony Caterina in Ward 7. Whether one looks at provincial voting patterns or federal, it's clear that Caterina, as a former Alberta Alliance candidate, is out of step ideologically with the Alberta Avenue area he is running in, his general reasonableness notwithstanding. Brendan van Alstine has been campaigning for a very long time now, and the Iveson case suggests that whether he fits with the area's ideological lean is quite likely more important than the campaign. Scott McKeen is also running here, and although normally someone who throws his hat in the ring so late in the game is unlikely to win, McKeen might have started fund-raising and door-knocking long ago, with him keeping it on the QT in order to remain the Edmonton Journal's salaried civic affairs reporter for as long as possible.

I'm actually going to be living in Ward 7 until the end of October - I met van Alstine and one of his campaign people when he was out with his dog on 118 Ave Thursday evening - but legally I've remained resident at my parents' place in Clareview for years, such that if I was going to vote it would have to be in Ward 4.

In Ward 4 we've got a Satanist in the candidate mix, which has attracted criticism to such a degree that you'd think he was in league with the Devil or something.  The candidate's unforgivable sin is rather his profanation of the Queen's English. Now maybe Mr Robb (photo at right) is correct that "the contraversial closure of the ECCA... will result in huge property tax increases, many deaths, and destruction of a historic site" and maybe he isn't. But what is most certainly not correct is having the first letter of the alphabet represented twice in "controversial." And as for describing the airport closure as "a blantant disregard for democracy," is not the combining of the word "blatant" with "bland" a watering down of the alleged blatancy? Also running in Ward 4 for "city councel" is Ken Atkinson. "Councel" might be more tolerable here if Mr Atkinson hadn't managed to use the dictionary spelling elsewhere on his blog. I mean, you'd think that with two variant spellings, he'd have cause for pause and a bit of a think about which of the two variants he's going to run with.

The candidate's unforgivable sin is rather his profanation of the Queen's English. Now maybe Mr Robb (photo at right) is correct that "the contraversial closure of the ECCA... will result in huge property tax increases, many deaths, and destruction of a historic site" and maybe he isn't. But what is most certainly not correct is having the first letter of the alphabet represented twice in "controversial." And as for describing the airport closure as "a blantant disregard for democracy," is not the combining of the word "blatant" with "bland" a watering down of the alleged blatancy? Also running in Ward 4 for "city councel" is Ken Atkinson. "Councel" might be more tolerable here if Mr Atkinson hadn't managed to use the dictionary spelling elsewhere on his blog. I mean, you'd think that with two variant spellings, he'd have cause for pause and a bit of a think about which of the two variants he's going to run with.

UPDATE (Sept 27):

In response to a comment this post continues on the matter of land value taxation.

3 comments:

OK, I'm not an economist, so I'm going to ask for your patience here, and ask a few question.

How exactly does would this tax work as compared to our current system (with examples)?

You don't tax the building, just the land, is that it? And you tax the land based on what exactly (examples, please)?

Who will pay more and who will pay less under this system?

And how will it drive people to live in the inner city?

Hey, Brendan's Campaign Manager (not partner, haha, and she'd be pretty upset), here.

I'm actually pretty interested in land-value taxation, especially hybrid systems. My understanding is that Edmonton used to have this at the beginning of its existence.

My area of city planning is more transportation than land-use, but do I see the potential for land-value taxation to turn parking lots into high-rises downtown? You bet.

I'm not sure what the effect would be in areas where the primary control is restrictive zoning (i.e. the majority of the city, be it low-density residential, or otherwise), since the land value isn't really fully manifest. Switching systems now could also be too much economic shock to the system for a lot of areas (and people).

I'm also a little fuzzy on what would happen out in the fringes. The land value of new suburbs is entirely dependent on them being developed, so new buyers might be a little shocked to see their taxes rise pretty dramatically, but maybe you've looked into this more than me.

Ok, I decided to write a new blogpost to answer some of David's questions.

I also adjusted this post slightly re just who's who relative to Brendan v. A to be as inconclusive as possible. I may be able to address some of Brian's comments, aboves, later.

Post a Comment